Navigating the ECB Fee Determination Calendar 2024: A Complete Information

Associated Articles: Navigating the ECB Fee Determination Calendar 2024: A Complete Information

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Navigating the ECB Fee Determination Calendar 2024: A Complete Information. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Navigating the ECB Fee Determination Calendar 2024: A Complete Information

The European Central Financial institution (ECB) performs a pivotal function in shaping the financial panorama of the Eurozone. Its financial coverage choices, significantly rate of interest changes, considerably influence inflation, borrowing prices, and total financial development. Understanding the ECB’s price determination calendar for 2024 is essential for companies, traders, and anybody within the Eurozone’s financial trajectory. This text offers a complete overview of the anticipated schedule, analyzes the components influencing the ECB’s choices, and explores potential situations for the yr forward.

The 2024 ECB Fee Determination Calendar: A Tentative Schedule

Whereas the exact dates for all 2024 ECB conferences aren’t launched far prematurely, a common schedule will be anticipated based mostly on previous patterns. The ECB usually holds financial coverage conferences roughly each six weeks. These conferences culminate in press conferences the place the President of the ECB, at the moment Christine Lagarde, pronounces the selections and offers commentary on the financial outlook. The calendar often consists of eight conferences per yr, specializing in rate of interest choices and broader financial coverage technique. We are able to count on an analogous sample for 2024. Particular dates are typically introduced a couple of months prematurely, often on the ECB’s official web site. It is essential to seek the advice of the ECB’s official web site for essentially the most up-to-date and correct info because the yr progresses.

Key Components Influencing ECB Fee Choices in 2024

The ECB’s choices aren’t arbitrary. They’re meticulously crafted based mostly on a posh interaction of financial indicators and forecasts. A number of key components will closely affect the ECB’s price choices all through 2024:

-

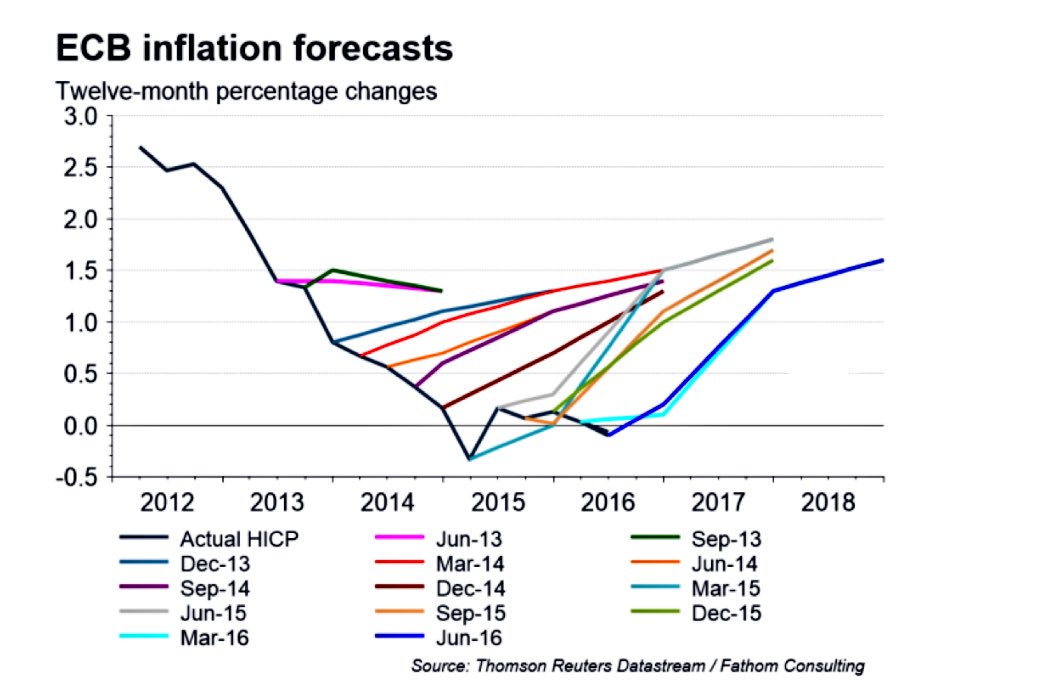

Inflation: This stays the ECB’s major focus. The goal is to take care of worth stability, outlined as an inflation price of two% over the medium time period. Inflation figures, measured by the Harmonised Index of Shopper Costs (HICP), might be carefully scrutinized. Persistent inflation above the goal will possible result in additional price hikes, whereas a big slowdown may immediate a pause and even price cuts. The persistence of underlying inflation, excluding unstable vitality and meals costs, might be significantly essential.

-

Financial Development: The Eurozone’s financial efficiency is one other essential issue. Sturdy development may enable the ECB to proceed its tightening cycle, whereas a big slowdown or recession may necessitate a extra cautious strategy, probably involving a pause and even price cuts. GDP development figures, employment information, and enterprise sentiment indicators might be carefully monitored.

-

Geopolitical Dangers: World occasions, corresponding to the continued warfare in Ukraine, vitality worth volatility, and worldwide commerce tensions, can considerably influence the Eurozone financial system and affect the ECB’s choices. Geopolitical uncertainty can result in elevated market volatility and necessitate a extra cautious financial coverage stance.

-

Trade Fee: The Euro’s change price in opposition to different main currencies, significantly the US greenback, can affect inflation and commerce flows. A robust Euro can curb inflation by making imports cheaper, whereas a weak Euro can increase exports however probably gas inflation. The ECB will think about the change price’s influence on worth stability and total financial situations.

-

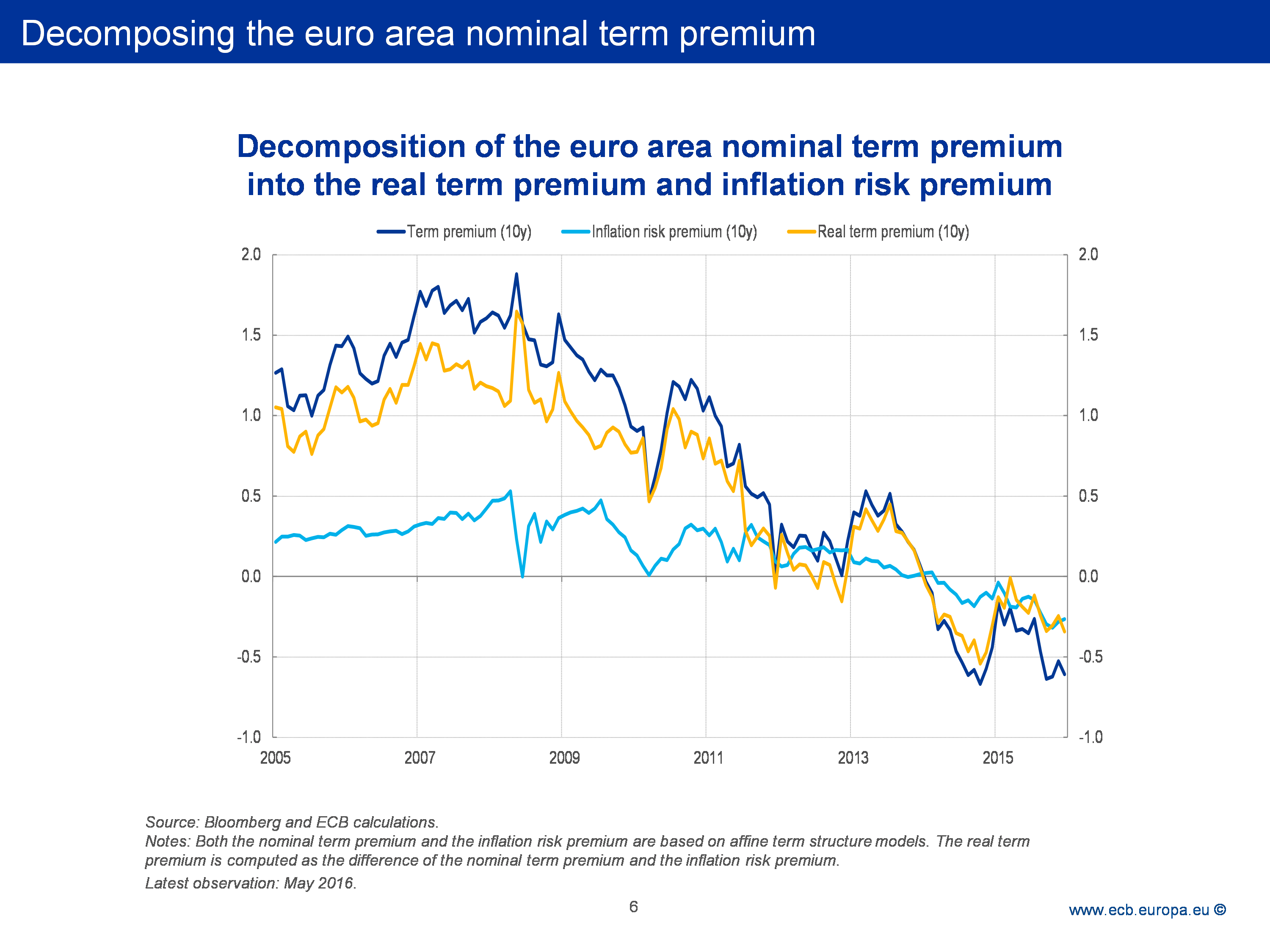

Monetary Stability: The well being of the Eurozone’s monetary system is paramount. The ECB will assess the potential dangers to monetary stability stemming from excessive rates of interest, debt ranges, and potential vulnerabilities throughout the banking sector. Sustaining monetary stability may constrain the ECB’s means to aggressively elevate rates of interest.

Potential Eventualities for 2024:

A number of situations are doable for the ECB’s price choices in 2024, relying on how the aforementioned components evolve:

-

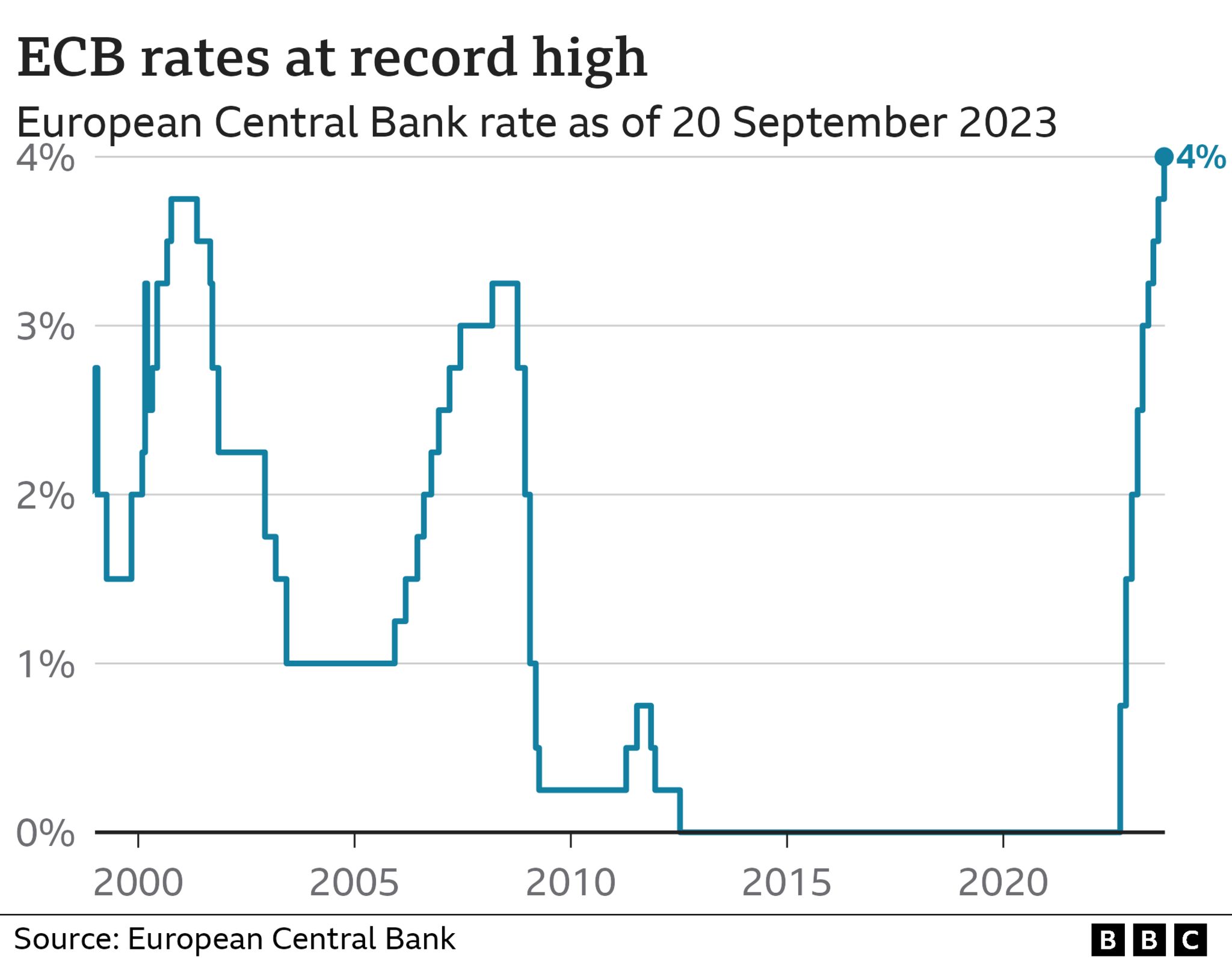

Situation 1: Continued Fee Hikes: If inflation stays stubbornly excessive and financial development stays comparatively strong, the ECB may proceed its tightening cycle in 2024, albeit at a slower tempo than in 2022 and 2023. This state of affairs suggests additional will increase within the deposit facility price and the primary refinancing operations (MRO) price.

-

Situation 2: Pause and Evaluation: If inflation exhibits indicators of cooling down, however stays above the goal, the ECB may resolve to pause its price hikes to evaluate the influence of earlier will increase on the financial system. This state of affairs suggests a interval of stability in rates of interest, permitting the ECB to observe the consequences of previous tightening measures.

-

Situation 3: Fee Cuts: If inflation falls considerably beneath the goal and the Eurozone financial system experiences a big slowdown or recession, the ECB may even think about chopping rates of interest to stimulate financial exercise. This state of affairs is much less possible within the early phases of 2024 however may turn out to be extra possible if financial situations deteriorate considerably.

-

Situation 4: Focused Measures: Past rate of interest changes, the ECB may make use of different focused measures to affect financial situations. This might embrace changes to its quantitative easing (QE) applications or different liquidity administration instruments. These measures could be used at the side of rate of interest changes or independently, relying on the financial circumstances.

Analyzing the ECB’s Communication:

Understanding the ECB’s communication is essential. The press conferences following every assembly present priceless insights into the ECB’s pondering and future intentions. Pay shut consideration to the language utilized by President Lagarde and different Governing Council members. Phrases like "persistent," "important," "gradual," and "data-dependent" provide clues in regards to the ECB’s possible future actions. Analyzing the minutes of the conferences, launched a couple of weeks later, offers much more detailed info on the discussions and rationale behind the selections.

Impression on Companies and Traders:

The ECB’s price choices have far-reaching penalties. Companies will face adjustments in borrowing prices, impacting funding choices and profitability. Traders want to regulate their portfolios accordingly, contemplating the influence on bond yields, fairness valuations, and forex change charges. Understanding the ECB’s price determination calendar and the components influencing its choices is important for knowledgeable decision-making in each the enterprise and funding spheres.

Conclusion:

The ECB price determination calendar for 2024 might be a key determinant of the Eurozone’s financial efficiency. Whereas the exact schedule and choices stay unsure, understanding the components influencing the ECB’s decisions and analyzing its communication are essential for navigating the financial panorama. By carefully monitoring inflation information, financial development indicators, geopolitical dangers, and the ECB’s personal communication, companies and traders can higher anticipate and adapt to the altering financial coverage surroundings. Bear in mind to all the time seek advice from the official ECB web site for essentially the most correct and up-to-date info on assembly dates and choices. The yr 2024 guarantees to be a dynamic interval for the Eurozone financial system, and staying knowledgeable in regards to the ECB’s actions is paramount for achievement.

Closure

Thus, we hope this text has offered priceless insights into Navigating the ECB Fee Determination Calendar 2024: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!