Navigating the 2024 Fed FOMC Assembly Calendar: A Information for Buyers and Market Analysts

Associated Articles: Navigating the 2024 Fed FOMC Assembly Calendar: A Information for Buyers and Market Analysts

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Navigating the 2024 Fed FOMC Assembly Calendar: A Information for Buyers and Market Analysts. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Navigating the 2024 Fed FOMC Assembly Calendar: A Information for Buyers and Market Analysts

The Federal Open Market Committee (FOMC) conferences are pivotal occasions within the world monetary calendar. Their choices on rates of interest, financial coverage, and financial projections straight impression market volatility, funding methods, and the general well being of the US and world economies. With 2024 promising to be one other yr of serious financial uncertainty, understanding the FOMC assembly schedule and the potential implications of every assembly is essential for traders, companies, and policymakers alike.

This text offers an in depth overview of the projected 2024 FOMC assembly calendar, analyzing the historic context, potential influencing elements, and the seemingly market reactions to every resolution. It is essential to notice that whereas the dates are typically recognized prematurely, the particular outcomes of every assembly stay unpredictable till the bulletins are made.

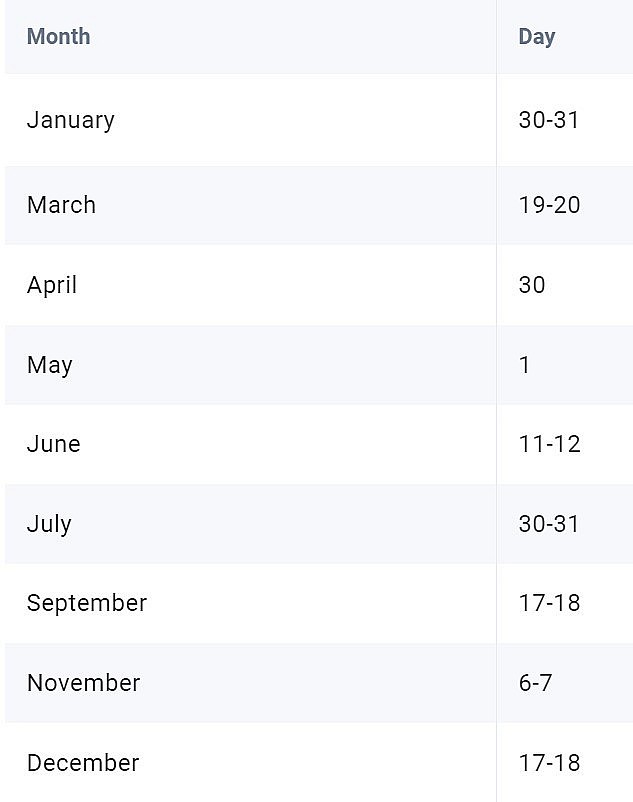

The 2024 FOMC Assembly Calendar (Projected):

The exact dates for the 2024 FOMC conferences are usually launched a number of months prematurely by the Federal Reserve. Whereas the precise dates might range barely, the overall schedule normally follows a sample of eight commonly scheduled conferences all year long, with the opportunity of unscheduled conferences if deemed obligatory by the committee. A typical calendar would appear like this (Be aware: These are projected dates and ought to be verified with the official Federal Reserve web site nearer to the time):

- Assembly 1: Late January/Early February

- Assembly 2: March

- Assembly 3: Could

- Assembly 4: June

- Assembly 5: July

- Assembly 6: September

- Assembly 7: October/November

- Assembly 8: December

Analyzing the Historic Context and Potential Influences:

Predicting the FOMC’s choices requires analyzing a number of key elements:

-

Inflation: The first mandate of the FOMC is to keep up worth stability. Persistent inflation above the goal price (typically 2%) will seemingly result in continued rate of interest hikes. Conversely, if inflation reveals indicators of cooling, the FOMC would possibly contemplate pausing and even reversing its tightening coverage. Knowledge factors just like the Client Worth Index (CPI) and the Producer Worth Index (PPI) will probably be intently scrutinized earlier than every assembly.

-

Unemployment Charge: The FOMC additionally considers employment ranges when making its choices. A low unemployment price can sign a powerful economic system, probably justifying additional price will increase to stop overheating. Nonetheless, excessively excessive unemployment would possibly immediate the FOMC to prioritize job progress, even on the danger of barely increased inflation.

-

Financial Development: GDP progress figures, together with indicators like manufacturing output and shopper spending, present insights into the general well being of the economic system. Robust financial progress would possibly assist additional price hikes, whereas sluggish progress may result in a extra cautious strategy.

-

International Financial Situations: The FOMC does not function in a vacuum. International occasions, resembling geopolitical instability, worldwide commerce disputes, and monetary crises in different international locations, can considerably affect its choices. The interconnectedness of the worldwide economic system implies that the FOMC should contemplate worldwide elements when setting financial coverage.

-

Market Reactions to Earlier Conferences: The FOMC fastidiously screens market reactions to its earlier choices. Unexpectedly sturdy or weak market responses can inform their future methods.

Potential Market Reactions to 2024 FOMC Choices:

The market’s response to every FOMC assembly will closely rely on the particular choices made and the way they align with market expectations. A number of eventualities are attainable:

-

Charge Hike Shock: If the FOMC raises rates of interest extra aggressively than anticipated, it may result in a sell-off within the inventory market, as increased charges enhance borrowing prices for companies and customers, probably slowing financial progress. Conversely, the US greenback would possibly strengthen.

-

Charge Hike Pause or Lower: A pause in price hikes or an sudden price reduce may set off a rally within the inventory market, as traders interpret it as an indication that the FOMC is prioritizing financial progress over inflation management. The US greenback would possibly weaken.

-

Shift in Ahead Steering: Modifications within the FOMC’s ahead steering – their communication concerning the future path of financial coverage – can considerably impression market sentiment. Hawkish steering (suggesting additional price hikes) can result in market declines, whereas dovish steering (suggesting a extra accommodative stance) can result in market good points.

-

Unanticipated Occasions: Unexpected financial shocks or geopolitical occasions may considerably alter the FOMC’s plans and result in unpredictable market reactions.

Methods for Navigating the 2024 FOMC Assembly Calendar:

Buyers and market analysts can make use of a number of methods to navigate the 2024 FOMC assembly calendar:

-

Keep Knowledgeable: Intently observe financial information releases, FOMC statements, and commentary from Fed officers to achieve insights into the potential path of financial coverage.

-

Diversify Investments: A diversified funding portfolio may help mitigate the dangers related to FOMC choices.

-

Regulate Asset Allocation: Take into account adjusting your asset allocation primarily based in your danger tolerance and expectations for FOMC actions. For instance, in case you anticipate additional price hikes, you would possibly contemplate shifting in direction of much less interest-rate-sensitive belongings.

-

Monitor Market Sentiment: Take note of market reactions to FOMC choices and regulate your methods accordingly.

-

Search Skilled Recommendation: Take into account consulting with a monetary advisor to develop a personalised funding technique that aligns along with your targets and danger tolerance.

Conclusion:

The 2024 FOMC assembly calendar will probably be a essential interval for the worldwide economic system. Understanding the historic context, potential influencing elements, and certain market reactions to every resolution is crucial for knowledgeable decision-making. By staying knowledgeable, diversifying investments, and monitoring market sentiment, traders and analysts can higher navigate the uncertainties and potential alternatives offered by the FOMC’s actions all year long. Bear in mind to all the time confirm data from official sources just like the Federal Reserve web site and seek the advice of with monetary professionals for personalised steering. The knowledge supplied on this article is for instructional functions and shouldn’t be thought of monetary recommendation.

Closure

Thus, we hope this text has supplied beneficial insights into Navigating the 2024 Fed FOMC Assembly Calendar: A Information for Buyers and Market Analysts. We hope you discover this text informative and useful. See you in our subsequent article!